Auras Insurance Review: The Real Story Behind Their Travel Coverage

Planning a trip abroad and panicking about healthcare costs? Yeah, been there. That nightmare scenario where you end up in a foreign hospital with a bill that costs more than your house payment? That’s exactly why I decided to test Auras Insurance for my recent European adventure.

After dealing with their Auras travel insurance for six months and actually using it (spoiler: I got food poisoning in Rome), here’s my completely honest take on whether this coverage is worth your money.

What is Auras Insurance?

Auras Insurance specializes in travel and international medical coverage for people who don’t want to gamble with their health while exploring the world. They’re not your typical big-name insurance company, but they’ve carved out a solid niche in the Auras international insurance space.

Auras Insurance specializes in travel and international medical coverage for people who don’t want to gamble with their health while exploring the world. They’re not your typical big-name insurance company, but they’ve carved out a solid niche in the Auras international insurance space.

The company offers everything from Auras student travel insurance to comprehensive Auras medical insurance plans. Their focus is on providing affordable coverage without the bureaucratic nightmare that usually comes with insurance claims.

What caught my attention initially was their straightforward approach. No confusing jargon, no hidden fees buried in 50-page policy documents. Just clear coverage options and honest pricing.

My Personal Experience with Auras

Let me tell you about Rome. Day three of what was supposed to be a perfect Italian getaway, and I’m doubled over in my hotel bathroom thanks to some questionable street food. Not exactly the cultural experience I had planned.

This is where Auras emergency medical insurance actually proved its worth. Called their 24/7 helpline at 2 AM (because food poisoning doesn’t follow business hours), and within 20 minutes I had directions to the nearest English-speaking clinic.

The clinic visit, medications, and follow-up care cost about €400 total. My Auras medical insurance covered every penny, and I didn’t have to pay upfront or deal with reimbursement hassles. The claim was processed while I was still recovering.

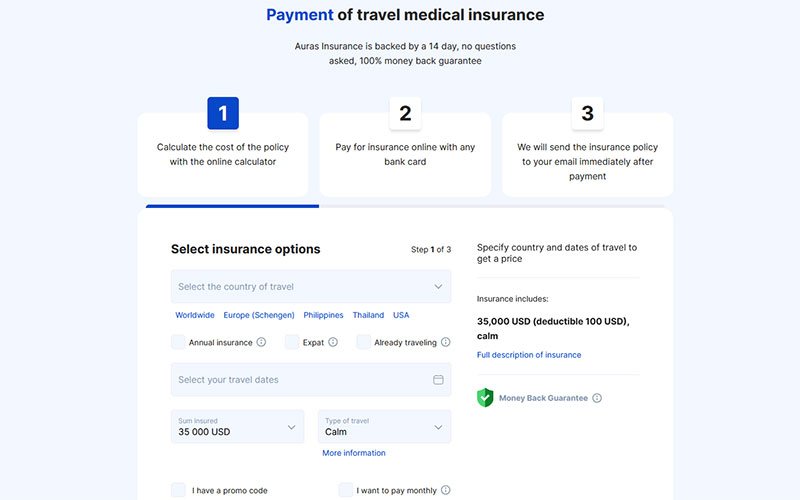

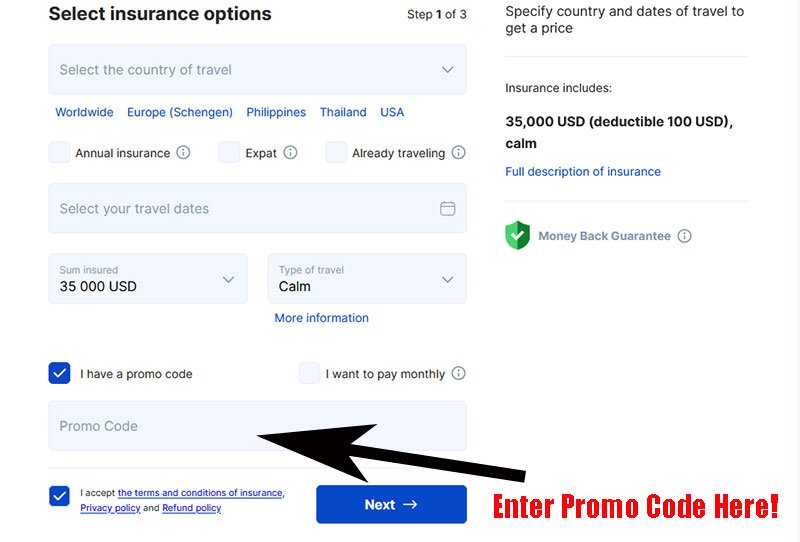

Looking for travel coverage? Right now you can get up to 10% OFF on travel medical insurance!

Key Features That Actually Matter

-

Comprehensive Medical Coverage

Auras health insurance goes beyond basic emergency care. They cover everything from routine doctor visits to emergency surgery, prescription medications, and medical evacuation if needed.

-

Trip Protection Benefits

Auras trip protection includes coverage for trip cancellation, interruption, and baggage loss. Not just medical stuff – they understand travel involves more than just health risks.

-

Student-Specific Plans

Auras student travel insurance recognizes that college kids have different needs and budgets. Coverage includes sports injuries, study-abroad specific situations, and mental health support.

-

Visitor Coverage Options

Auras visitor insurance works for people coming to visit family or friends. Parents visiting from overseas? This coverage has them sorted without breaking the bank.

-

Flexible Plan Options

Auras short-term insurance plans range from single trips to annual coverage. No forced long-term commitments if you just need coverage for one vacation.

Coverage Details Breakdown

The Auras Insurance coverage details are refreshingly transparent. Here’s what you actually get:

Medical Benefits:

- Emergency medical expenses up to policy limits

- Prescription drug coverage

- Emergency dental care

- Medical evacuation and repatriation

- Mental health support

Travel Benefits:

- Trip cancellation and interruption

- Baggage loss and delay coverage

- Flight accident protection

- Emergency travel assistance

Additional Services:

- 24/7 multilingual customer support

- Direct billing with healthcare providers

- Online claim submission and tracking

Pricing and Plan Options

Auras Insurance plans and pricing vary based on your age, trip duration, and coverage level. Here’s the general breakdown:

- Basic plans start around $30-50 for short trips

- Comprehensive coverage runs $80-150 for most international trips

- Annual plans range from $200-500 depending on coverage limits

- Student plans are typically 20-30% cheaper than standard rates

The best place to buy Auras travel medical insurance is directly through their website. Third-party sites often add fees or limit your plan options.

The Good and Not-So-Good

What I Loved

- Auras Insurance claim process was surprisingly smooth

- Customer service actually answered the phone quickly

- No upfront payments required at many healthcare providers

- Clear policy language without insurance-speak

- Competitive pricing for comprehensive coverage

- Auras Insurance online quotes are accurate and detailed

Areas for Improvement

- Limited coverage in some remote destinations

- Pre-existing condition exclusions can be strict

- Some exclusions aren’t clearly explained upfront

- Annual policy renewal could be more streamlined

Is Auras Insurance Legit?

Get Auras coverage and play it smart!

Is Auras Insurance legit was my first question too. After researching their background and using their services, I can confirm they’re a legitimate insurance provider with proper licensing and financial backing.

They’re not as well-known as giants like Allianz, but that doesn’t mean they’re unreliable. Sometimes smaller companies actually provide better customer service because they’re not juggling millions of policies.

The Auras Insurance customer reviews I found were mostly positive, with people praising their claim handling and customer support responsiveness.

How Auras Compares to Competitors

-

Auras Insurance vs Allianz Travel Insurance

Auras Insurance vs Allianz Travel Insurance comes down to size versus personalization. Allianz has more global recognition, but Auras offers more personalized service and often better pricing for similar coverage.

-

Auras Insurance vs Seven Corners

Auras Insurance vs Seven Corners is closer competition. Both focus on international coverage, but Auras tends to have clearer policy language and faster claim processing in my experience.

For affordable travel medical insurance Auras definitely holds its own against the bigger names while often providing better value.

Auras Insurance vs Allianz vs Seven Corners

Here’s how Auras Insurance compares with two well-known providers:

| Feature | Auras Insurance | Allianz Travel Insurance | Seven Corners Travel Insurance |

| Price Range | Affordable, budget-friendly | Higher-priced, premium | Mid-range to premium |

| Coverage Options | Travel medical, student, visitor, health | Trip protection, medical, annual plans | Travel medical, trip protection, student |

| Global Availability | Yes, worldwide | Yes, worldwide | Yes, worldwide |

| Customer Support | 24/7 emergency assistance | 24/7 customer service | 24/7 emergency hotline |

| Best For | Budget-conscious travelers, students | Luxury travelers, business trips | Families, frequent travelers |

| Claims Process | Simple, online | Well-established, but paperwork heavy | Reliable, moderate paperwork |

| Discounts | Yes, 10% OFF coupon code | Rarely offers discounts | Occasional discounts |

| Overall Value | Affordable, practical choice | Premium but expensive | Balanced mix of coverage and value |

Customer Experience and Support

The Auras Insurance customer reviews I’ve read align with my experience. Their support team knows their stuff and doesn’t make you jump through unnecessary hoops.

When I called about my Rome situation, the representative didn’t just give me a clinic address – they actually called ahead to make sure someone would be available and spoke English. That’s the kind of service that makes insurance worth paying for.

The Claims Process Reality

Let’s talk about what everyone really wants to know – the Auras Insurance claim process. Here’s how it actually worked:

- Called their emergency line from Rome

- Got pre-authorization for treatment

- Visited approved clinic (no upfront payment)

- Submitted receipts through their mobile app

- Claim processed within 48 hours

No paperwork nightmares, no “we need 17 different forms” nonsense. Just straightforward service when I needed it most.

Who Should Consider Auras Insurance?

Perfect for:

- International travelers wanting comprehensive coverage

- Students studying abroad

- Visitors to the US or other countries

- People wanting personalized customer service

- Budget-conscious travelers who don’t want to sacrifice coverage

Might want alternatives if:

- You prefer big-name brand recognition

- You’re traveling to very remote locations

- You have complex pre-existing conditions

- You only need basic emergency coverage

Getting the Best Deal

Get 10% OFF Auras Insurance and travel worry-free!

Want to save money? Here are some insider tips:

- Auras Insurance online quotes often include web-only discounts

- Look for Auras Insurance coupon code promotions during travel seasons

- Auras Insurance special offers are frequently available for students

- Annual plans offer better value if you travel regularly

The Auras Insurance official site is your best bet for current promotions and accurate pricing.

Policy Management and Renewal

The Auras Insurance renewal process is pretty painless. They’ll send reminders before your policy expires, and you can renew online without starting from scratch.

Auras Insurance policy options can be modified during renewal if your travel patterns have changed. More coverage, less coverage, different destinations – they’re flexible.

My Final Verdict

Click here to get your personalized Auras Insurance quote!

After six months with Auras Insurance and actually using their services in a real emergency, here’s my honest assessment:

Rating: 4.1/5 stars

Auras Insurance reviews from other customers seem to echo my experience. They’re not perfect, but they deliver where it counts – when you actually need help.

The combination of affordable travel medical insurance Auras pricing with solid customer service makes them a strong choice for most travelers. They might not have the marketing budget of the big guys, but they’ve got the fundamentals right.

Look, insurance isn’t exciting. Nobody wants to think about getting sick or injured while traveling. But when it happens (and trust me, it can happen to anyone), having solid coverage makes all the difference.

Auras Insurance proved they’re there when you need them. In Rome, dealing with food poisoning in a foreign country, the last thing I wanted was insurance hassles. Instead, I got efficient service and complete coverage.

The Auras Insurance benefits and exclusions are clearly explained, the pricing is competitive, and the customer service actually works. For international travel coverage, that’s pretty much everything you need.

Ready to protect your next trip? Don’t forget about that 10% OFF deal on travel medical insurance!

FAQs:

1. How quickly does Auras Insurance process claims?

Most Auras Insurance claims are processed within 48-72 hours for standard medical expenses. Emergency claims with proper pre-authorization can often be handled immediately through direct billing with healthcare providers, meaning you won’t need to pay upfront.

2. Does Auras Insurance cover pre-existing medical conditions?

Auras Insurance has a pre-existing condition exclusion period, typically requiring stable health for 60-180 days before coverage begins. However, they offer a pre-existing condition waiver if you purchase coverage within a certain timeframe of making your initial trip deposit.

3. Can I extend my Auras Insurance policy while traveling?

Yes, Auras Insurance allows policy extensions in most cases, provided you request the extension before your current policy expires and you haven’t filed any claims. Extensions can typically be purchased online or through customer service.

4. What countries does Auras Insurance not cover?

Auras Insurance excludes coverage in countries under travel advisories or sanctions. They also may have limited coverage in certain high-risk destinations. Check their current exclusion list on their website before purchasing coverage for your specific destination.

5. Does Auras Insurance cover adventure sports and activities?

Basic Auras Insurance policies exclude high-risk activities like mountaineering, skydiving, or professional sports. However, they offer adventure sports riders that can be added to your policy for additional coverage of these activities at an extra cost.

6. How do I contact Auras Insurance in an emergency?

Auras Insurance provides 24/7 emergency assistance through their international helpline. The number is provided in your policy documents and insurance card. They offer multilingual support and can help coordinate care, authorize treatments, and handle direct billing.

7. What’s the maximum age limit for Auras Insurance coverage?

Auras Insurance typically covers travelers up to age 80, though coverage options and pricing may be limited for older travelers. Some plans have lower age limits, while others offer specialized coverage for senior travelers with different terms and conditions.

8. Can I purchase Auras Insurance for domestic travel within my home country?

Auras Insurance primarily focuses on international travel and may not offer comprehensive domestic coverage. However, they do provide some domestic travel benefits for trip cancellation and interruption. Check with them directly about coverage for travel within your home country.

9. How does Auras Insurance handle prescription medication coverage abroad?

Auras Insurance covers prescription medications that are medically necessary for covered conditions, up to your policy limits. They can help coordinate prescription transfers and ensure you can access needed medications while traveling, subject to local laws and regulations.

10. What documentation do I need to file an Auras Insurance claim?

For medical claims, you’ll typically need receipts, medical reports, proof of payment, and your policy information. For trip-related claims, you may need booking confirmations, cancellation notices, or receipts for additional expenses. Their mobile app and website make it easy to submit documentation electronically.

Bottom line: If you’re planning international travel and want reliable coverage without paying premium prices, Auras Insurance deserves serious consideration. Just read your policy details carefully and make sure their coverage matches your travel plans.

Your future self (hopefully healthy, but just in case) will thank you for making the smart choice.